FinTech Fusion: The Next Giants Emerge

For wealthy individuals, the integration of financial services and technology goes beyond mere ease; it signifies a transformation in wealth management, risk mitigation, and privileged access. The forthcoming generation of financial technology leaders will avoid duplicating current payment or lending frameworks; instead, they will address the specific requirements of wealthy clienteles, combining advanced technology with personalized, privacy-centered financial offerings that revolutionize the elite finance segment.

AI-Enhanced Personal Wealth Advisors

Moving past standard robo-advisors, future leaders will incorporate artificial intelligence alongside human financial advisors to devise exceptionally tailored strategies. These services will evaluate not only market shifts but also the aspirations tied to family legacies, tax consequences in various regions, and even tangible assets like real estate and art. They will adjust dynamically to global economic changes, providing customized hedging instruments that protect wealthy investments from fluctuations, significantly surpassing traditional wealth management options.

Global Asset Intelligence Networks

Affluent individuals frequently possess assets across the world, and the next wave of FinTech leaders will address issues related to international assets. By utilizing blockchain technology for straightforward ownership verification and AI for instant compliance with regulations, these networks will eradicate bureaucratic obstacles and hidden costs. They will consolidate multi-currency assets, automate international tax optimization, and deliver insightful information regarding market opportunities in different regions, transforming global wealth management into a strategic advantage rather than a challenge.

As scrutiny over the finances of wealthy individuals increases, FinTech leaders will position themselves as reliable partners in compliance. By using unchangeable blockchain records and smart contracts, they will automate reporting processes, validate asset authenticity, and ensure compliance with global anti-money laundering statutes. Unlike conventional trustees, these platforms will provide round-the-clock transparency, allowing clients to oversee compliance instantaneously while protecting sensitive financial data through robust encryption measures.

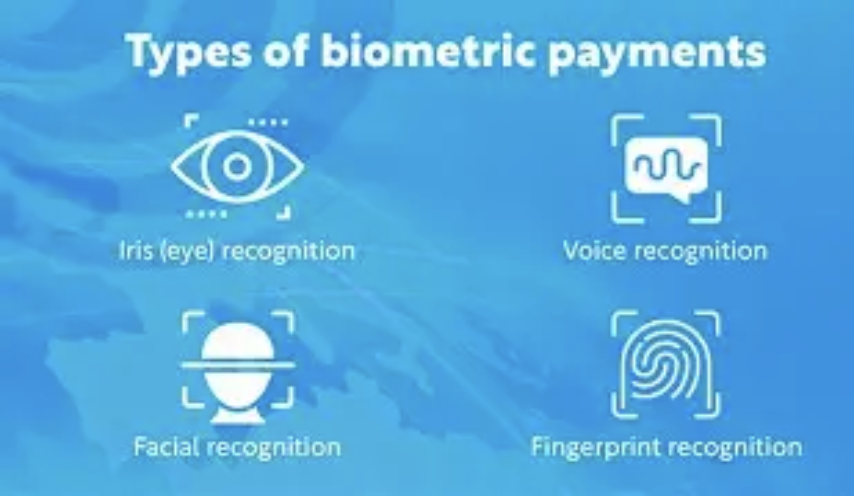

Biometric-Enabled Premium Payment Networks

The forthcoming era of high-end transactions emphasizes exclusivity and security. FinTech leaders will create closed ecosystems for valuable transactions, utilizing biometric technology (such as iris scans and voice identification) to replace traditional passwords. These ecosystems will connect with private banking services, luxury retailers, and family offices, facilitating smooth and secure transactions for expensive purchases—from luxury yachts to artworks—while ensuring complete confidentiality, which is crucial for wealthy buyers.

Rather than offering independent applications, the next generation of FinTech leaders will weave financial solutions into luxurious lifestyles. Envision a platform that collaborates with private jet services, high-end real estate agents, and art galleries, providing immediate, customized financing or insurance for significant acquisitions. These systems will utilize data derived from the lifestyle preferences of affluent users to pre-qualify exclusive financial offerings, merging convenience with the sophistication valued by wealthy clients.

Pioneers in Sustainable Wealth Technology

Wealthy groups are increasingly placing importance on investments that align with environmental, social, and governance criteria, and FinTech leaders are set to drive this change. They will harness AI to evaluate investments for genuine sustainability (moving beyond superficial efforts) and provide tools for tracking impact that assess both financial gains and social or environmental significance. These platforms will link users to exclusive opportunities in sustainable private equity and green bonds, making ethical investing an advanced, lucrative endeavor rather than a trade-off.

These upcoming leaders will flourish by recognizing that wealthy consumers desire more than just technology; they seek financial offerings that reflect their status, values, and intricate requirements. Through the combination of innovation and exclusivity, they will reshape the landscape of premium finance.

(Writer:Cily)