Plug-in Hybrids vs. EVs: Which Fits You?

The Luxury of Energy Flexibility

Plug-in hybrids (PHEVs) provide a valuable advantage for wealthy individuals: energy arbitrage. Picture completing 50 miles of daily tasks using just the battery power, then easily switching to a V8 engine for a weekend escape—no worries about running out of battery, no sacrifices needed. Luxury brands like Bentley and Porsche excel at this, with their PHEV models offering over 25 miles of electric capability while still boasting more than 600 horsepower. For those who own several homes, PHEVs are the perfect fit: recharge at your urban penthouse and refuel at your country estate where charging options might be limited. This versatility is not only practical; it represents a status symbol that showcases unlimited freedom.

EVs as Smart Grid Assets

Electric vehicles (EVs) serve more than just transportation; they operate as mobile batteries. Premium models, such as the Lucid Air, can send electricity back to your home when demand is highest, potentially reducing energy costs by 30% for households with heavy usage. In some cases, energy companies even compensate EV owners for supplying energy to the grid during urgent situations, effectively turning your vehicle into a source of extra income. For tech-oriented individuals, combining an EV with a solar-powered home creates a self-sustaining energy setup, significantly decreasing dependence on public electricity sources. This relationship changes EVs from assets that lose value into essential parts of an eco-friendly lifestyle.

Depreciation Dynamics

Wealthy buyers often overlook how much resale value is important, yet the data shows a different reality. After three years, plug-in hybrid electric vehicles (PHEVs) keep about 45% of their worth, exceeding the performance of electric vehicles (EVs) in areas where charging availability is unreliable. In contrast, high-end EVs from brands like Tesla and Rivian in tech hotspots such as Silicon Valley retain over 50% of their value due to high demand for their used cars equipped with the latest software. The key difference comes from their usage: a PHEV mainly running on gas loses value more quickly than one that is mostly operated on electric power. For enthusiasts, rare EVs like the Rimac Nevera are already increasing in value, with certain models selling for over 20% more than their original prices—something not seen in the PHEV market.

The Time Cost Equation

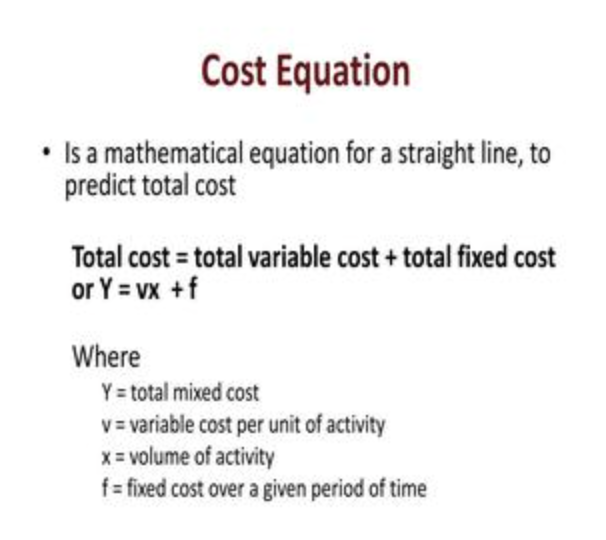

The time it takes to charge isn’t just a hassle; it’s a form of luxury expense. While a 20-minute fast charge for an electric vehicle might look speedy, for someone making \(500/hour, it results in \(167 of lost productivity. Plug-in hybrid electric vehicles (PHEVs) solve this issue by allowing refueling in just 5 minutes at any gas station. However, the situation changes with home charging: putting in a 150kW DC charger requires an investment of $15,000, but it allows you to start each day with a fully charged battery. For those who travel often, valet charging at upscale hotels now provides free battery top-ups, offering more convenience for electric cars compared to PHEVs when traveling. Ultimately, the real expense hinges on how much you value your time in various situations.

Regulatory Arbitrage Opportunities

Electric vehicles (EVs) provide special advantages in cities worldwide. For instance, in London, a £250,000 EV can bypass the daily congestion fee of £12.50, leading to an annual savings of £6,500 for those who commute regularly. Similarly, in Singapore, EVs enjoy reduced road taxes—saving as much as £10,000 each year compared to plug-in hybrid electric vehicles (PHEVs). However, PHEVs excel in areas where tax credits are substantial: in the U.S., they can receive up to $7,500 for having larger batteries, while some European nations waive import duties for them. International owners with residences in different countries can benefit from having both types of vehicles—using an EV in busy city areas and a PHEV in the countryside—to take full advantage of regulations across various regions.

(Writer:Seli)