China's Wearable Dominance – Innovation, Scale, and Global Impact

Technical Breakthroughs: Pioneering Flexible Innovations

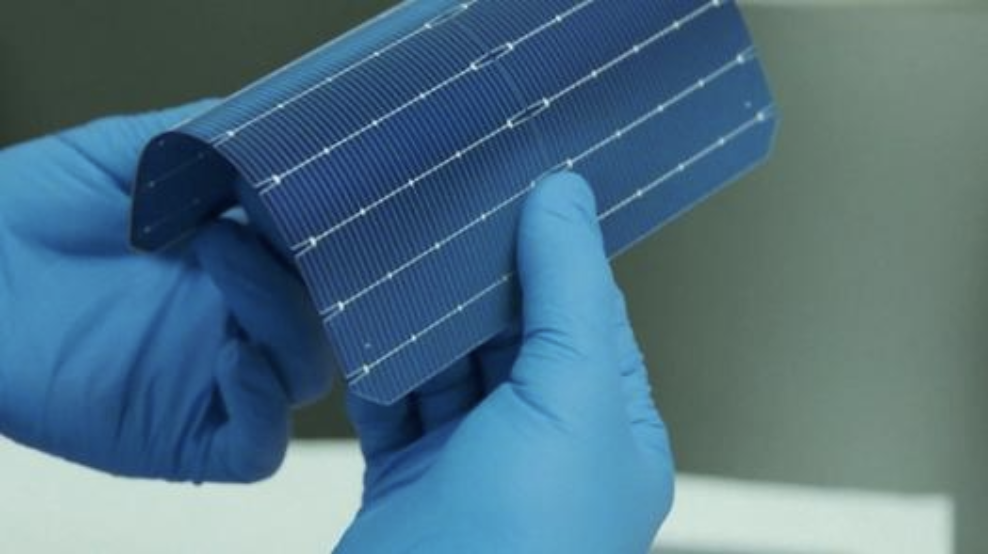

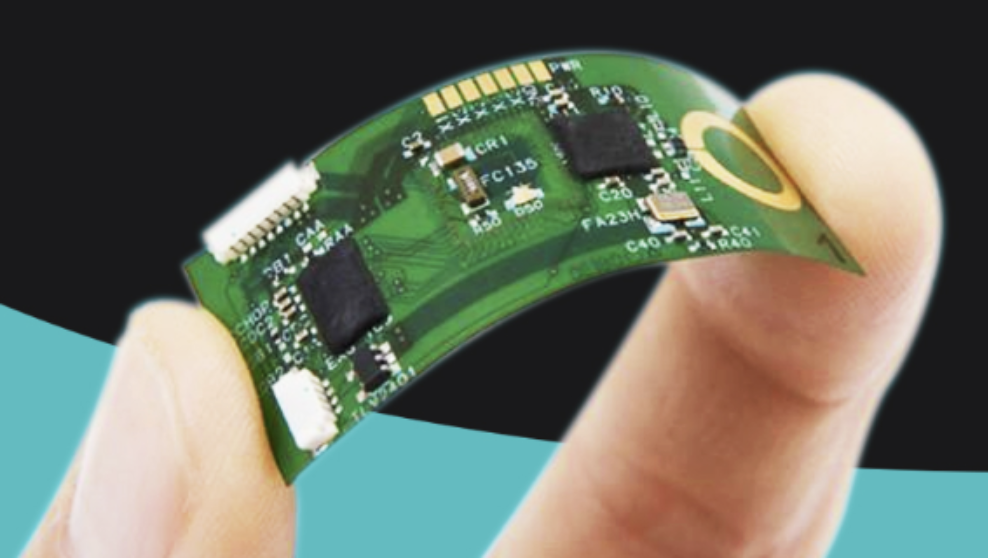

China’s dominance in flexible electronics stems from relentless technological advancement. Fudan University’s 2024 breakthrough in fiber battery technology, published in Nature, introduced a flexible power source with 128 watt-hours per kilogram energy density—capable of charging a smartwatch for seven days while enduring 10,000 bending cycles. This innovation integrates seamlessly into textiles, enabling clothing to function as both energy storage and wearable devices. Meanwhile, BOE, a global display leader, supplies 40 percent of the world’s smartwatches with flexible OLED screens featuring a 1-millimeter bending radius and 200 percent stretch capability. These displays, used in Nio’s luxury electric vehicles and Huawei’s foldable smartphones, highlight China’s edge in integrating flexible tech across industries.

The country’s R&D ecosystem thrives on interdisciplinary collaboration. The Suzhou Nano Institute’s 2023 development of snake-shaped metal grid electrodes achieved a record FoM (figure of merit) of 15,000—maintaining 95 percent conductivity even under 130 percent tensile strain. Such breakthroughs underpin next-gen wearables, from stretchable health monitors to textile-integrated sensors.

Market Leadership: Scaling Innovation Globally

China’s technical prowess translates directly to market dominance. In Q2 2025, Huawei retained its global lead in wrist-worn device shipments with 9.9 million units (20.3% market share), while Xiaomi surged 61 percent to 9.5 million units, narrowing the gap with Huawei. Together, Chinese brands control over 30 percent of the global wearable market, which is projected to reach 115 billion United States dollars by 2025.

This success hinges on cost-effective scalability. Chinese wearables typically cost 30 percent less than Western alternatives without compromising quality. For instance, Xiaomi’s fitness trackers with medical-grade sensors retail at half the price of comparable Apple products, driving adoption in both developed and emerging markets. China’s flexible circuit board (FPC) industry, which accounts for over 40 percent of global production, further streamlines manufacturing costs.

Ecosystem and Policy Support: Fueling Growth

A robust industrial ecosystem and government backing solidify China’s position. The country’s 24 billion United States dollars investment in flexible electronics R&D has fostered clusters like Suzhou’s Nano City, where roll-to-roll production achieves 85 percent yield rates, churning out 50 million flexible sensors monthly. This infrastructure enables rapid prototyping and mass production, cutting time-to-market by 50 percent compared to Western competitors.

Policy frameworks like the Made in China 2025 initiative prioritize flexible electronics as a strategic sector, offering tax incentives and grants for breakthroughs in materials science and IoT integration. By 2028, China’s flexible electronics market is projected to reach 301 billion United States dollars, driven by demand from wearables, medical devices, and automotive electronics.

Challenges and Future Outlook

Despite its lead, China faces hurdles. Over 70 percent of high-purity materials for flexible displays and batteries still rely on imports from Japan and South Korea. Additionally, international competitors like Samsung and Apple hold 83 percent of core patents in advanced materials and display technologies. To address this, China is investing in indigenous solutions: Contemporary Amperex Technology Co. (CATL) is developing solid-state flexible batteries, while Huawei partners with Tsinghua University to develop AI-optimized sensor arrays.

Dr. Lisa Wang of the Global Electronics Forum notes, “China’s strength lies in translating lab innovations into mass-market applications—a strategy that will deepen its dominance as global demand for wearables surges”. With the Asia-Pacific wearable market growing at 20 percent annually (double Europe’s rate), China is poised to capture 45 percent of the global flexible electronics market by 2030.

As the world increasingly relies on smartwatches, health monitors, and connected devices, China’s wearable dominance is reshaping the industry. By merging cutting-edge R&D with scalable manufacturing, the country is not just producing devices—it’s defining the future of flexible electronics. From fiber batteries in smart clothing to stretchable displays in medical devices, China’s innovations are proving that flexibility is the key to tomorrow’s tech.

(Writer:Lorik)